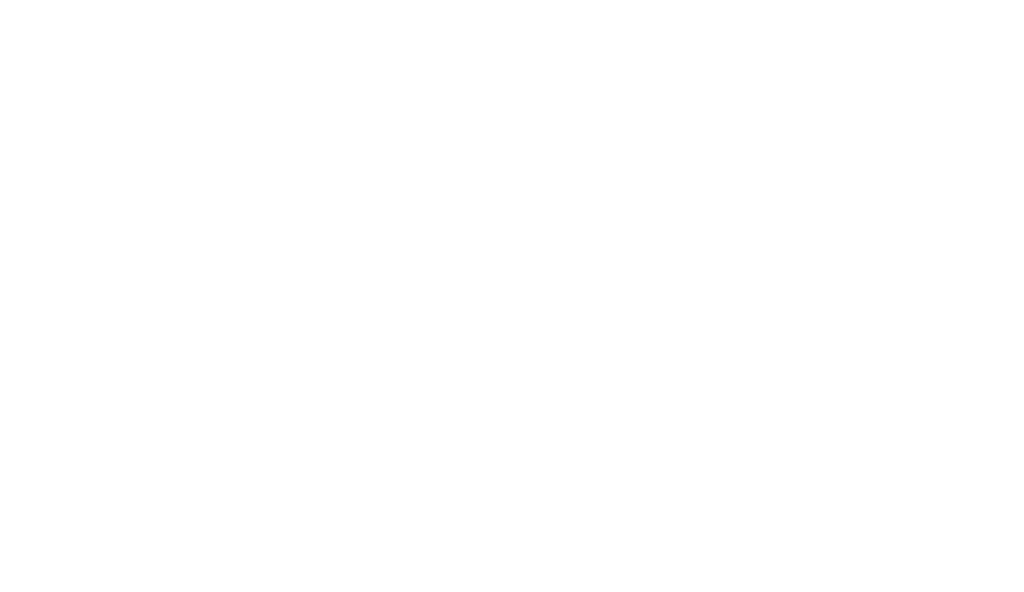

How does driver’s ed school insurance work is a common question for parents and teens preparing to start driving lessons. With so many new things to learn, like road signs and car control, it’s easy to forget about what happens if there’s an accident during a lesson. That’s where this special kind of insurance comes in. It protects the driving school, the instructor, and most importantly, the student while they’re learning how to drive.

Driver’s Ed School Insurance Breakdown

| Component | What It Covers |

|---|---|

| Commercial Auto Insurance | Covers cars used in driving lessons for accidents or damage |

| General Liability | Covers injury or property damage during lessons or on premises |

| Professional Liability | Protects instructors from legal claims due to teaching mistakes |

| Workers’ Compensation | Covers injuries to instructors while working |

| Student Accident Coverage | Ensures the student is protected if hurt in a training accident |

| Vehicle Damage Coverage | Fixes training cars after minor or major crashes during lessons |

| Insurance Discount Boost | Helps students get cheaper insurance after course completion |

| DMV Certification | Required for school to legally run and offer valid course hours |

| Trust & Confidence | Helps parents feel safer about where their child is learning |

| Long-Term Benefits | Promotes safe driving habits and better insurance deals later |

So, what exactly is this insurance? It’s a plan that driving schools have to make sure everyone stays safe and covered during lessons. When a student is behind the wheel for the first time, they are nervous and may make mistakes. These mistakes can sometimes lead to small accidents or bigger problems. But because the student is under the school’s training program, it’s not their personal car insurance that takes the hit. Instead, the school’s insurance steps in to cover the damages. That’s the short answer to how does driver’s ed school insurance work, but there’s more to it than just that.

Driving schools are required by law in most states to have this type of insurance. It usually includes coverage for the cars used in training, liability if someone gets hurt, and even protection for the instructors. These vehicles often have extra safety features like dual controls, so instructors can help take over if needed. The insurance helps in case something still goes wrong. It also covers things like property damage or injury to others if a student hits something or someone during a lesson.

Now let’s say a student accidentally bumps into another car during a driving session. Normally, if this happened outside of a driving school, their personal car insurance would have to pay. But since it happened during a lesson, the driving school’s insurance handles everything. That includes fixing the car, paying for damages to the other person’s car, and making sure the instructor and student are okay. This is one of the biggest reasons how does driver’s ed school insurance work is important to understand—because it protects beginners from having to face huge costs while they’re still learning.

Another thing people often wonder is if taking driving school classes can help reduce their future insurance costs. And the answer is yes, it usually does. Many auto insurance companies offer discounts to teens who complete a certified driver’s ed course. The reason is simple. Insurance companies know that students who go through proper training are more likely to follow traffic rules, drive safely, and avoid accidents. So, completing driver’s ed is not only smart for safety—it’s smart for saving money too.

Parents should also check if the driving school has full insurance before signing up. A good school will always be open about their insurance coverage and will explain how it works. If a school doesn’t have proper insurance, that’s a big red flag. Because if something goes wrong and they’re not covered, it could cause legal problems or unexpected bills for the family. So when choosing a driving school, asking about their insurance is just as important as asking about their pass rate.

Let’s also talk about instructors. They’re not just protected by auto coverage; they often have professional liability insurance too. That means if a parent says the instructor wasn’t teaching well or did something wrong during a lesson, the insurance would protect them legally. It gives peace of mind to instructors who are doing their job and trying their best to keep things safe. The school may also have workers’ compensation insurance for instructors, just in case they get injured while working.

Today, with more young drivers on the road and distracted driving being such a big issue, this type of insurance plays a bigger role than ever. Driving schools must be responsible for their students and vehicles. And when you fully understand how does driver’s ed school insurance work, it becomes clear why it’s a necessary part of the learning process.

Another benefit of driver’s ed insurance is that it helps maintain trust. Parents feel more confident sending their kids to schools that are insured and well-managed. Students feel less pressure knowing that if something unexpected happens, the school has it under control. Instructors can focus on teaching instead of worrying about who pays for what in case of a fender-bender.

It’s also worth mentioning that this insurance is a part of meeting state laws. Many U.S. states won’t allow a school to operate or offer certification unless it has valid insurance. This means students can’t even count the training hours if the school isn’t legally approved. So if you’re looking into driver’s ed, always check if the school is certified by your state’s department of motor vehicles.

Finally, let’s wrap up by looking at the bigger picture. Learning to drive is a major milestone. It comes with a lot of excitement but also responsibility. Insurance makes this process safer for everyone involved. From the first time a teen turns the key to the day they pass their test, driver’s ed school insurance is there in the background—quietly making sure everyone’s protected. So the next time you hear someone ask, how does driver’s ed school insurance work, you’ll know it’s more than just a policy. It’s peace of mind for students, parents, and teachers.

Now you know the real answer to how does driver’s ed school insurance work. It keeps students safe during lessons, covers the school in case of accidents, and builds trust between parents and instructors. It also helps lower costs in the long run and ensures driving schools follow the law. Behind every safe driving lesson is an insurance policy that’s working quietly to protect everyone on the road. And that’s exactly why this type of insurance matters so much in 2025 and beyond.

FAQs About Driver’s Ed School Insurance

Q1: What is driver’s ed school insurance?

A1: Driver’s ed school insurance is a special type of coverage that protects the driving school, instructors, and students during driving lessons. It covers accidents, injuries, and legal claims that may happen during training sessions.

Q2: Does the student need their own insurance during driving school?

A2: No, students are usually covered under the driving school’s insurance while taking lessons. This means if there’s an accident during class, the school’s policy takes care of it—not the student’s personal insurance.

Q3: Can taking driver’s ed lower my car insurance rate later?

A3: Yes, most insurance companies offer discounts to students who complete a certified driver’s education course. The discount can be anywhere from 5% to 20%, depending on the insurer.

Q4: What happens if a student crashes the car during a lesson?

A4: If a student causes an accident during a driving lesson, the driving school’s insurance covers the damages. The student and their family are not held financially responsible in most cases.

Q5: Is every driving school required to have insurance?

A5: Yes, in most U.S. states, a driving school must have insurance to operate legally and to offer state-certified driver’s ed courses. It’s a requirement for safety and compliance.

Q6: What if the instructor makes a mistake during a lesson?

A6: If the instructor is found to be at fault or behaves unprofessionally, the school’s professional liability insurance (sometimes called errors & omissions insurance) can cover any legal or financial claims.

Q7: How can I check if a driving school has proper insurance?

A7: You can ask the school directly. A professional driving school should be transparent and willing to share information about their insurance coverage, including liability and vehicle protection.

Q8: Does the insurance cover off-site driving lessons too?

A8: Yes, as long as the lesson is part of the official training program and approved by the school, the insurance generally covers off-site or on-road lessons as well.

Q9: What is dual control, and how does it relate to insurance?

A9: Dual control means the instructor’s car has pedals on both sides—one for the student and one for the teacher. It helps the instructor take control if needed, which can prevent accidents and reduce insurance claims.

Q10: Why is this insurance important for new drivers?

A10: Because new drivers are still learning and are more likely to make mistakes, this insurance keeps them protected. It ensures that any incidents during training don’t lead to big financial problems for the student or their family.

I am Muhammad Waqas and I am dedicated to promoting sustainable vehicles. Observing EV trends, studying the intricacies of the EV industry, and promoting new EV launches fall under my expertise. I have been working in this field for 5 years and making efforts for a sustainable and healthy future.